Window Takaful Operations

ABOUT TAKAFUL

TOWARDS UNDERSTANDING TAKAFUL

-

A source of danger or a possibility of incurring loss/ misfortune. The possibility of a premature death, a life-altering disability, or loss of any material possession like a house or a car through fire and theft is a risk all too real to be ignored or left unaddressed. These risks involve significant financial losses that could leave entire families destitute and businesses insolvent in a single blow. Insurance has been the modern way of mitigating these risks through a process of risk transference in exchange of premiums, but not without reservations. Whereas, insurance itself is commendable, its mode of conduct and contract has been a subject of opposition within the parameters of Shari’ah due to the presence of Riba, Gharrar, and Qimar.

-

The word Takaful originates from the Arabic language and means “joint or mutual guarantee”. The system

of Takaful is based on the principles of brotherhood, mutual solidarity, and Taburru which is encouraged

by the Shari’ah. In our society, we have varying implications of Takaful: the joint-family system for one and

co-operative societies for another in which risks and financial losses are distributed amongst the

participants and help is mutually extended to each other in times of need on the principle of Ta’awun.

Exactly the same happens in Takaful, where participants pool their recourses so that they might be able

to help each other in the time of need. -

Insurance or for that matter even Takaful is considered by some to be against the Islamic concept of Tawakkul. This belief is actually based on a misunderstanding and therefore not true, for Takaful does not suggest rejecting or abandoning the means or resources, but instead to use various agencies while leaving the outcome to Allah Almighty’s Will. This is what Takaful stands for, and which was also sanctioned by Prophet Muhammad (peace be upon him) in a Hadith where he directs the Bedoiun in the following words having seen him leaving his camel untied considering this as being Tawakkul on Allah Almighty.

Read More -

The shareholders firstly would create a Waqf Pool in order to initiate the Takaful activities. Because they had been the ones to establish this Waqf they are called the Waqif, whereas the ownership of the Waqf is transferred to Allah Almighty. People are able to benefit from it for their risk mitigation purposes after acquiring a membership of this Waqf Pool which is legally referred to as the Participants’ Takaful Fund or PTF.

Read More -

The company or the operator serves as the Wakeel or the Manager of the Waqf Fund and charges a ‘Wakala fee’ for it. This fee is paid from the Waqf Fund. As the Wakeel, the Operator must invest the funds available in the Waqf Pool in Shari’ah-compliant businesses for profits on the basis of “Mudharabah”. Since the Operator is the Mudarib (working partner) and the Waqf Fund is the Rabul-ul Maal (sleeping partner), any profits made from the investments are shared between the two on pre-defined percentages.

-

- Contributions paid by the participants

- Claim payments received from Re-Takaful Operators

- Profits made from investing the funds available in the Waqf Pool

- Qard-e-Hasana, paid by the Operator in an event of any Deficit

- Miscellaneous donations to the Waqf Pool

-

- Claim payments

- Re-Takaful payments

- Wakala Fee of the Operator

- Operator’s percentage in the investment profits made

- Portion of surplus which is distributed to the participants

- Repayment of Qard-e-Hasana

- Any donations paid on the recommendation of Shariah Advisor/Shariah Board

-

There are two classes of Takaful:

- Family Takaful

- General Takaful

Family Takaful or Life Takaful

The participants of Family Takaful mitigate their risks pertaining to their lives by acquiring a membership of the Waqf Fund. In addition to the protection element, participants can also use Family Takaful for their investment needs through another Fund called the Participant’s Investment Account (PIF). A point to remember is that in General Takaful there is no PIF.

Read More

OUR

TAKAFUL PRODUCTS

INDIVIDUAL HEALTH TAKAFUL

GROUP FAMILY TAKAFUL

SHARIAH

COMPLIANCE

SHARIAH BOARD PROFILE

SUPPLEMENTAL RULES GHTPF

WAQF DEED

WAQF RULES

Supplemental Rules (IFTPF)

Supplemental Rules (GFTPF)

Supplemental Deed (IFTPF)

Supplemental Deed (GHTPF)

Supplemental Deed (GFTPF)

GROUP FAMILY TAKAFUL

GROUP HEALTH TAKAFUL

SCREENING CRITERIA

Shariah Advisory Board Profiles

FREQUENTLY

ASKED QUESTION:

Insurance Ordinance 2000

Insurance Rules 2002

Takaful Rules 2012

[As quoted in Sunan At-Tirmidhi, 1981.]

The Fiqh Council of World Muslim League (1398/1978) resolution and The Fiqh Council of Organization of Islamic Conference (1405/1985) in Jeddah resolved that conventional insurance as presently practiced is Haraam, and that cooperative insurance (Takaful) is permissible and fully consistent with Shariah principles. Hence, conventional insurance is prohibited for Muslims (because it contains the elements of Riba, Al Maisir, and Al Gharar). By contrast, Takaful provides risk protection in accordance with Shariah based on the principles of Ta’awun (mutual assistance), brotherhood, piety and ethical operations.

Point # 1: The fundamental difference between conventional insurance and Takaful is the “Change of nature of contract” from Aqd-e-Muawaza to Aqd-e-Taburru. This has eliminated Riba; and Rendered Gharar and Qimar/Maysir Ineffective.

Point # 2: Contributions goes into the Waqf Fund & Waqf Fund belongs to Allah (SWT).

Point # 3: The Waqf Fund pays the claims.

Point # 4: Contributions are invested only in Shari’ah Compliant business avenues.

Point # 5: An independent Shariah Advisor/Shariah Board supervises business activities for Shariah compliance.

DOWNLOADS

BROCHURE

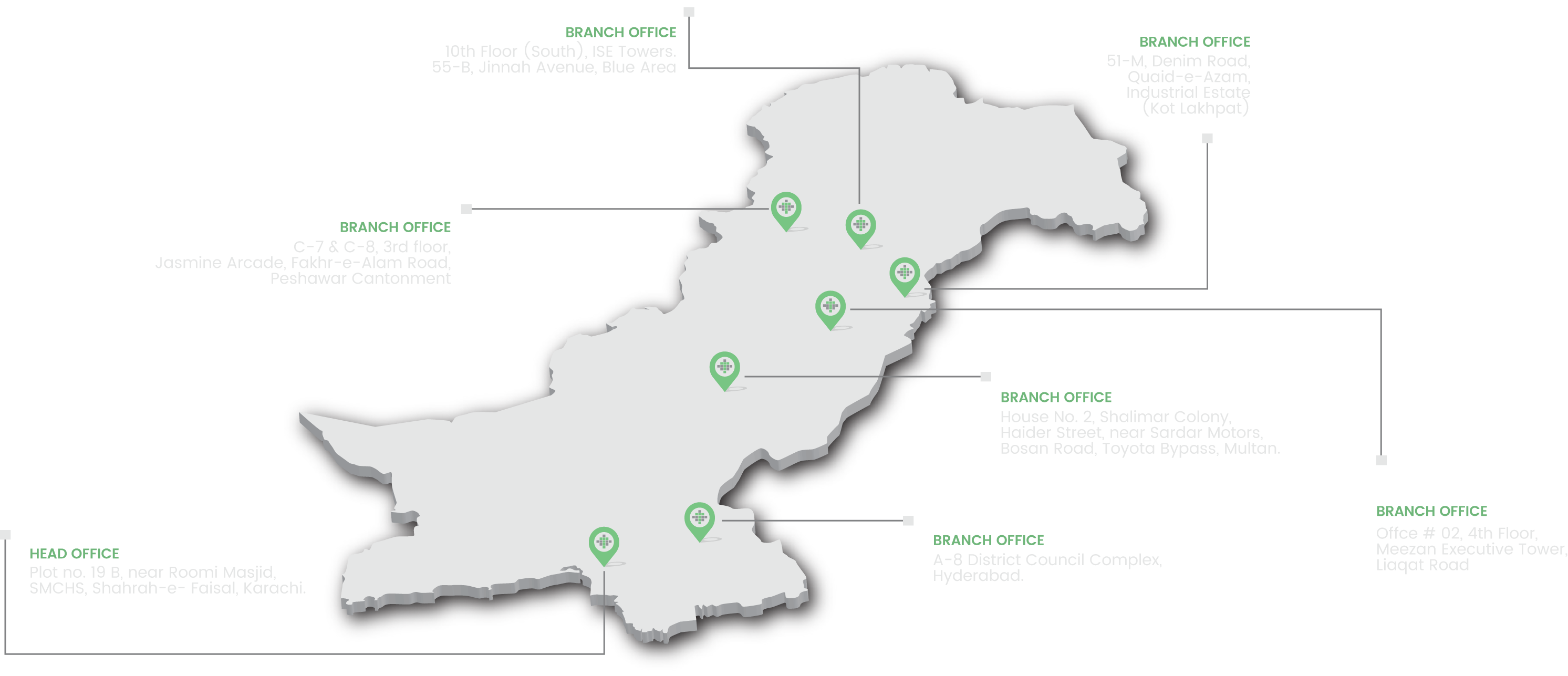

TPL OFFICES